Income Smoothing Describes the Concept That

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. The marginal tax rate is low at low income levels and gets progressively higher up to a point.

Smoothing The Path Balancing Debt Income And Saving For The Future Page One Economics St Louis Fed

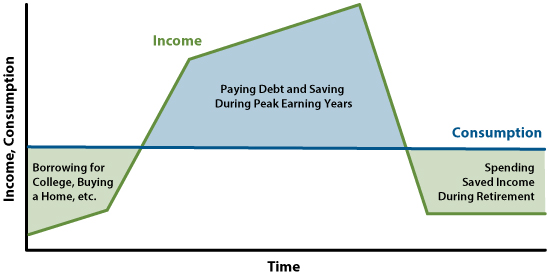

Figure 2 below depicts the factors.

/GettyImages-1010501198-bbe6f998bfb44985bcc9f647fd89891b.jpg)

. At very high income levels the marginal tax rate falls. ALL YOUR PAPER NEEDS COVERED 247. All nonparametric regression models involve finding some balance between fitting the observed sample of data model fit and smoothing the function estimate model parsimony.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Central to the concept of low-income is the importance of socio-economic characteristics and conditions on differences seen among various populations. In other words an analysis of immigrants in low-income necessarily requires offering reasons why things are different among various immigrant groups and the Canadian-born.

No matter what kind of academic paper you need it is simple and affordable to place your order with Achiever Essays. The marginal tax rate is constant across income levels. The marginal tax rate is high at low income levels and gets progressively lower as income levels increase.

Get 247 customer support help when you place a homework help service order with us. All individuals pay. Typically this balance is determined using some form of cross-validation which attempts to find a function estimate that does well for predicting new data.

/GettyImages-1153823593-91cb30ef5b134128a09897bf5c1b2b75.jpg)

Comments

Post a Comment